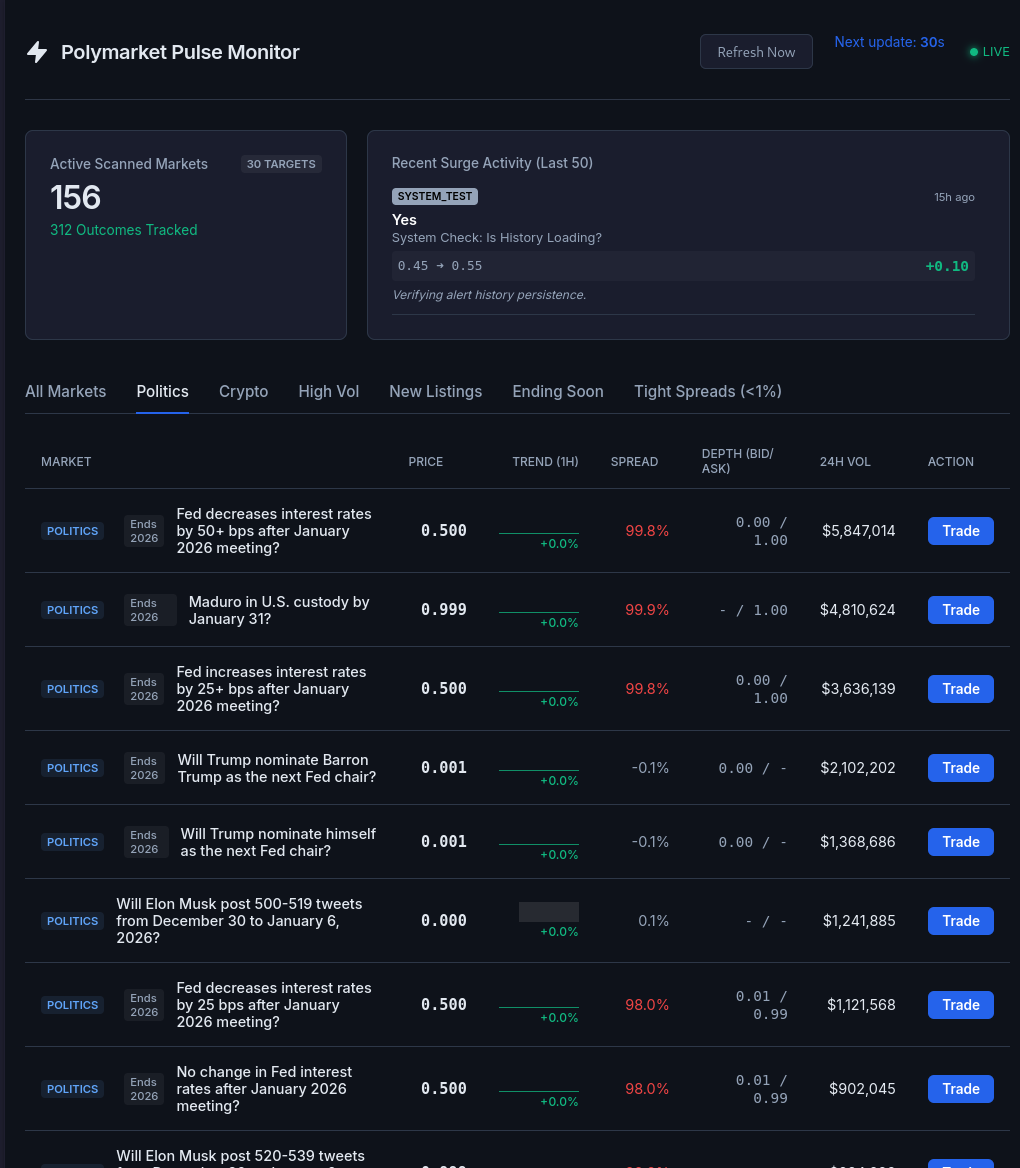

Prediction markets move fast. Blink and you miss it. Polymarket has basically become the global mood ring for elections, crypto, and “wait, why is this trending?” moments. But refreshing the site every few minutes is not a strategy, it’s a bad habit.

I wanted to know when something actually mattered. Not noise. Not random wobbles. Real conviction. So I built a Polymarket Surge Detector in Python that watches the market for me, in real time, without coffee breaks.

The Real Problem: Too Much Noise, Not Enough Signal

Polymarket is loud. Thousands of markets, constant price ticks, endless micro-movements that mean absolutely nothing. What I needed was something that could:

- Focus on what matters: High-volume areas like Politics, Crypto, and whatever the crowd is suddenly obsessed with.

- Ignore the chop: Small price wiggles are just markets breathing. I only care when something moves.

- Alert instantly: If something spikes, I want to know now, not after Twitter has already figured it out.

- Show me the big picture: A quick dashboard instead of twenty tabs and vibes.

The Solution: Let Python Watch the Market

The result is a local, modular monitoring system that polls Polymarket, tracks price behavior over time, and flags meaningful surges as they happen.

Tech Stack (Nothing Fancy, Just Effective)

- Python 3.10+ for the core logic

- asyncio + requests for efficient polling (started simple, then sped it up)

- Flask for a lightweight local dashboard

- JSON + Pickle to persist state without overengineering it

How It’s Put Together

The system breaks cleanly into four parts.

1. The Orchestrator (main_monitor.py)

This is the control room. It runs continuously and:

- Pulls the top 30–40 markets from key categories like Politics, Crypto, and Trending

- Deduplicates overlapping markets and favors clean, binary outcomes

- Fetches live order books for the relevant tokens

In short, it keeps the data sane before anything interesting happens.

2. The Surge Detector (monitor/surge.py)

This is where things get fun. Instead of reacting to a single price tick, the detector keeps a rolling window of price history (default is 30 minutes) and looks for:

- Velocity: Is the price moving fast or just drifting?

- Magnitude: Is this actually meaningful (5–10%+), or just noise?

- Volume: Is there real money behind it, or just wishful thinking?

If all three line up, we’ve got a surge.

3. The Alert Manager (monitor/alerts.py)

Once a surge is confirmed, this module handles the grown-up stuff:

- Prevents alert spam with a cooldown on repeat signals

- Formats alerts into something readable (0.34 → 0.48, not “number go up”)

- Persists alerts to disk so restarts don’t wipe the story

4. The Live Dashboard (dashboard_server.py)

A simple Flask app reads the current state and gives a clean overview of:

- Markets currently being tracked

- Recent surge alerts

- System health (so I know it’s watching even when I’m not)

No fluff, just signal.

Why This Actually Matters

Prediction markets are inefficient. News breaks, and prices often move before the headline hits your feed. Having a machine watching order books 24/7 gives you an edge spotting:

- Breaking news before it’s “breaking”

- Whale activity that quietly shifts probabilities

- Arbitrage setups between related markets

Humans are slow. Code isn’t.

What’s Next

This is version one, not the finish line. On the roadmap:

- Telegram alerts, because staring at a dashboard is optional

- News correlation, tying price moves to actual events

- Execution, meaning automated trades when confidence is high enough

The goal is simple: turn market chaos into something readable. If you’re trading prediction markets without a system like this, you’re not early. You’re just late, politely.

What do you think?

It is nice to know your opinion. Leave a comment.